Selling your home in Texas? Exciting! But before you start picturing that “SOLD” sign in your yard. Let’s talk about some important costs.

Many sellers don’t realize just how many expenses come with selling a home, and if you’re not prepared, they can eat into your profits fast.

Did you know home prices in Texas jumped 40% between 2019 and 2023? And in 2024 alone, 35,230 homes were sold in San Antonio—a 7% increase from the year before.

The good news? You can cut costs and keep more money in your pocket with the right plan. Let’s break it all down.

Factors That Affect Home Selling Costs In Texas

In Texas, selling a home usually costs around 12.92% of the sale price. If you sell a home for $350,000, you might pay about $45,217 in closing costs.

But it’s not all done. It changes depending on some factors,

- Location Matters: Selling in big cities like Austin, Fort Worth, or Houston? Expect higher costs due to competitive markets. Suburban areas may have lower agent fees but slower sales.

- Home Repairs & Improvements: Pre-sale repairs and upgrades (paint, flooring, curb appeal) can increase value but cost upfront.

- Property Taxes & HOA Fees: Texas has no state income tax but higher property taxes, impacting final costs.

- Timing of the Sale: Selling in spring or summer? Homes usually sell faster and at higher prices. Winter sales may require price reductions to attract buyers.

Breakdown of Home Selling Costs in Texas

There is not a certain % in the selling costs in Texas. But you can find out the cost with some calculations.

Real Estate Agent Commissions

The real estate agent commission is one of the biggest costs when selling a home. In Texas, the standard commission is around 5.76% of the home’s sale price, split between the buyer’s and seller’s agents.

For example:

- Selling a $350,000 home? Expect to pay about $21,000 in commissions.

- Selling a $500,000 home? That’s around $30,000 in commissions.

While this fee might seem high, a great agent can help you sell faster and at a higher price. If you want to save, you can negotiate a lower rate or explore discount brokerages, but remember that service levels may vary.

Closing Costs

Closing costs are the extra fees (excluding agent commissions) sellers pay when finalizing a home sale. In Texas, expect to pay about 3.51% of your home’s price in closing costs.

For a home worth $299,982, that’s around $10,528. While you might negotiate for the buyer to cover some costs, sellers often pay.

Experts suggest budgeting 8% of your home’s price—6% for agent commissions and 2% for other fees. A $345,000 home costs about $27,600 in total closing costs.

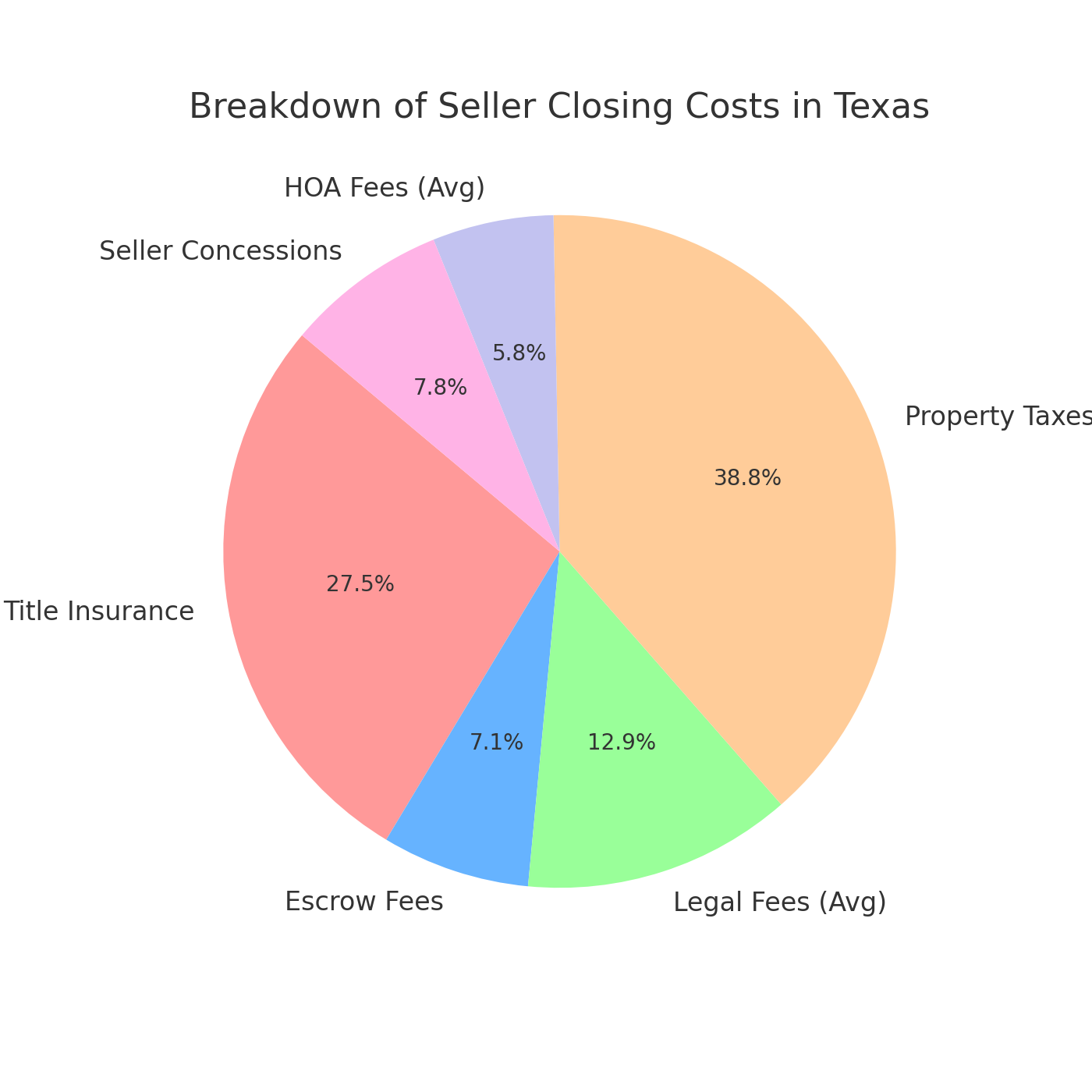

Common Closing Costs for Sellers in Texas

- Title & Escrow Fees – Title insurance (~$2,123) and escrow fees (~$550)

- Legal Fees – Optional but useful ($500–$1,500)

- Property Taxes – You pay taxes for the portion of the year you owned the home

- HOA Fees – If applicable, $300–$600

- Seller Concessions – Covering buyer’s costs or repairs (often includes a $600 home warranty)

Planning can help you budget for these expenses and avoid last-minute surprises!

Home Preparation Expenses

Unless you’re selling your Texas home “as-is” or to an iBuyer, expect to spend around $6,856 on average to get it market-ready and attract serious buyers.

This could be as simple as lawn mowing, deep cleaning, and decluttering. But some homes might need a bit more—like repairs or a fresh coat of paint.

According to Sandy Finkelstein of Fort Worth Property Group, Foundation issues can be a major red flag for buyers.

“If you see cracks in the walls from settling, have a pro patch them up. And if you’re worried about the foundation, get a free evaluation before listing. Addressing these concerns upfront makes selling smoother and more successful.”

Additional Expenses

Beyond the usual selling costs, there are a few extra expenses to consider when selling your Texas home.

– Moving Costs: Whether hiring professional movers or renting a truck, relocation expenses can add up quickly.

– Staging & Photography: High-quality listing photos and professional staging can help sell your home faster, but they come at a cost.

– Home Warranty for Buyers: Some sellers offer a one-year home warranty (around $600) to make their listing more attractive.

– Capital Gains Tax: If your home’s value has significantly increased, you might owe taxes on the profit—though many sellers qualify for exemptions.

Planning ahead for these costs can help you avoid surprises and make your home-selling process as smooth as possible!

Calculate The Selling Cost

Let’s break down the estimated selling cost based on a given home price. The total selling cost includes:

- Real Estate Agent Commission (5.76%)

- Closing Costs (Around 3.5%)

- Home Preparation Expenses (Approximately $6,856)

- Additional Expenses (Variable, but we’ll estimate $2,000 for moving, staging, and small repairs)

Example Calculation for a $400,000 Home:

|

Expense Type |

Percentage/Fixed Cost |

Amount |

|

Real Estate Agent Commission |

6% of $400,000 |

$24,000 |

|

Closing Costs |

3.5% of $400,000 |

$14,000 |

|

Home Preparation Expenses |

Fixed |

$6,856 |

|

Additional Expenses |

Estimated |

$2,000 |

|

Total Selling Cost |

— |

$46,856 |

Recent Changes in Texas Real Estate Practices

- Buyer-Agent Compensation (Aug 17, 2024): Buyers must sign an agreement before touring a home. Sellers no longer have to pay the buyer’s agent commission, and MLS listings no longer show compensation details.

- License Renewal (Oct 1, 2023): First-time renewals require a 30-hour Real Estate Brokerage course. Expired licenses go inactive immediately.

- TREC Form Changes (Jan 3, 2025): “Geothermal” is now included in Natural Resource Leases. Sellers must provide buyers with mold remediation certificates.

- Other Updates: HB 73 expands liability protection for landowners. The Texas Practicum is now a separate experience requirement.

These changes impact how homes are bought, sold, and licensed—stay informed!

Conclusion

So, yeah, that’s the quick recap of Texas home selling costs. However, Texas real estate is changing, from buyer-agent agreements to updated licensing and disclosure rules. Whether buying or selling, staying informed on these updates will help you make smarter decisions and avoid surprises.