Online shopping has changed how we spend money. Click, buy, repeat – it’s that simple. But this convenience often leads to overspending and budget problems.

Many families struggle with digital purchases because they feel different from cash transactions. You can’t see the money leaving your wallet. Credit cards and one-click buying make it too easy to spend without thinking.

This article will show you practical ways to control your online spending. You’ll learn how to set clear spending limits for internet purchases, track your digital expenses effectively, avoid common online shopping traps, and build healthy spending habits that stick.

I’ve helped hundreds of families regain control of their finances. These proven strategies work because they’re based on real experiences, not theory. Your goal is simple: spend online without breaking your budget. Let’s make that happen with a plan you can actually follow.

Understanding Your Online Spending Reality

You can’t control what you don’t measure. Most people have no idea how much they actually spend online each month.

Calculating Your Current Online Expenses

Start with your bank statements. Look at the last three months. This gives you a clear picture of your spending habits.

Separate your essential online spending from the fun stuff. Essential purchases include utility bills, grocery orders, and prescriptions. Everything else is discretionary spending.

Add up your monthly totals. You might be surprised by the numbers. Most people underestimate their online spending by 40-60%.

Look for spending spikes. Holiday seasons and stressful periods often show higher amounts.

Tip: Use your bank’s transaction search feature to filter by “online” or “e-commerce” merchants.

Recognizing Spending Triggers and Patterns

Your emotions drive many online purchases. You feel stressed, bored, or sad – then you shop.

Keep a simple log for one week. Write down your mood before each online purchase. Note if you were feeling anxious, scrolling social media, or celebrating something.

There’s a big difference between planned and impulse buying. Planned purchases happen when you research and wait 24 hours. Impulse purchases happen in minutes.

Watch out for subscription creep. These small monthly charges add up fast.

Tip: Keep a simple log for one week noting your mood before each online purchase.

Setting Your Online Spending Budget

Now comes the important part. Time to create guardrails that actually work.

Determining Your Online Budget Allocation

Start with your take-home pay. Subtract essentials like rent, utilities, groceries, and savings. What’s left is discretionary income.

Your online spending should be 8-12% of your take-home income. If you earn $4,000 monthly, that’s $320-480 for online purchases.

Break this into categories:

- Food delivery: 30%

- Entertainment: 20%

- Clothing: 25%

- Household items: 25%

Take your current spending and reduce it by 15%. This becomes your first target.

Tip: Start with your current spending level and reduce by 15% as your initial target.

Choosing Your Budget Control Method

Pick what fits your personality.

Method 1: Dedicated account. Transfer your monthly budget to a separate checking account. When it’s gone, you’re done.

Method 2: Weekly allowances. Divide monthly budget by four. Prevents early-month splurges.

Method 3: Category tracking. Set caps for each category. Track with an app or spreadsheet.

I recommend the dedicated account method. Simplest and hardest to cheat.

Tip: Use a separate debit card loaded only with your budgeted online spending amount.

I understand you’d like me to add explanations for the H3 sections under the H2 “Implementing the 50/30/20 Budget for Online Spending.” Here are the 100-word explanations for each H3:

Implementing the 50/30/20 Budget for Online Spending

This budgeting method helps organize your digital financial life by allocating specific percentages of your income to different spending categories online.

Categorizing Digital Expenses into Needs (50%)

Essential online services form the foundation of your digital budget allocation. This category includes mandatory monthly payments like internet connectivity, mobile phone plans, and streaming services you cannot function without.

Online grocery purchases, utility bill payments, and health insurance premiums processed through digital platforms also fall here. These expenses represent your non-negotiable financial obligations that maintain your basic standard of living.

When calculating this 50% allocation, focus on services that would significantly impact your daily routine if discontinued. Prioritize recurring payments that support your work, health, and fundamental communication needs.

Managing Online Wants (30%)

Your discretionary online spending encompasses entertainment and lifestyle choices that enhance your quality of life without being absolutely necessary. This includes multiple streaming subscriptions, online shopping for fashion items, digital game purchases, and food delivery services.

For instance, if you’re looking for casinos that accept PayPal, it’s important to treat that expense as part of your entertainment budget. Even though online gambling may feel like fun or a quick way to make money, it can quickly become a hidden drain on your budget if not properly tracked.

Travel bookings, concert tickets, and hobby-related online purchases also belong in this category. These expenses reflect your personal preferences and interests rather than basic survival needs.

The key is maintaining awareness of how much you spend on these enjoyable but optional digital services. This category allows flexibility while keeping your spending within reasonable boundaries for long-term financial health.

Allocating for Savings and Debt Repayment (20%)

Your future financial security depends on consistent online contributions to savings and debt reduction. Set up automatic transfers to high-yield savings accounts, emergency funds, and retirement portfolios through digital banking platforms.

Use online investment apps to build long-term wealth through diversified portfolios. Schedule additional debt payments beyond minimum requirements to reduce interest costs over time.

This category also includes contributions to specialized savings goals like vacation funds or major purchases. Digital tools make it easier to automate these transfers, ensuring you consistently prioritize your financial future without relying on manual reminders or willpower alone.

Tracking and Monitoring Your Online Budget

A budget without tracking is just a wish list. You need to know where you stand every few days.

Daily and Weekly Monitoring

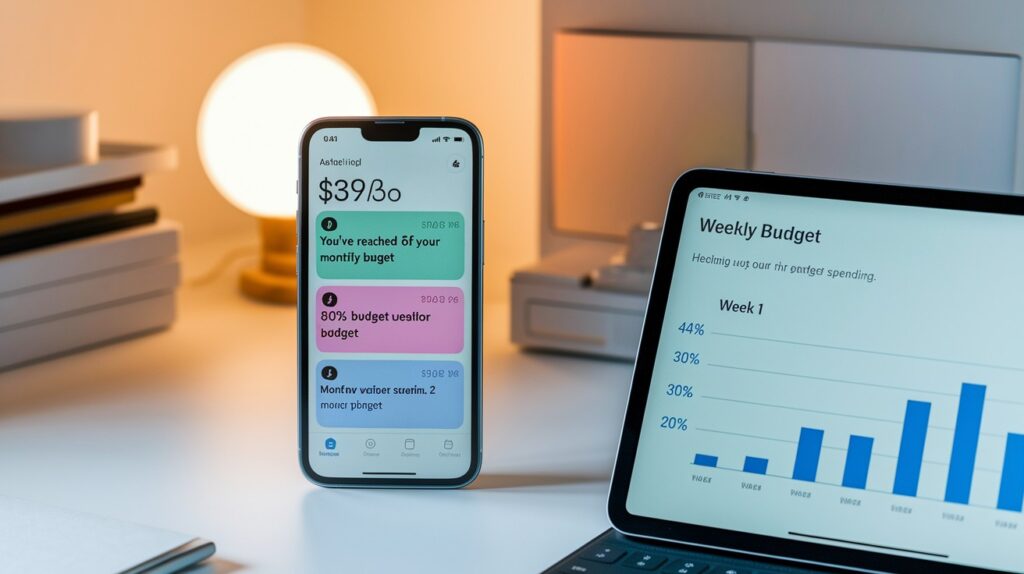

Check your spending balance every few days. Don’t wait until month-end to find out you’re over budget.

Review weekly spending against targets. If you spent 40% in week one, you’re heading for trouble.

Use your banking app’s spending categories. Most banks sort transactions automatically. This saves manual tracking headaches.

Set up alerts:

- Text at 50% of monthly budget

- Text at 80% of monthly budget

These work like fuel gauges. They warn you before you run out of money.

Tip: Set up text alerts when you reach 50% and 80% of your monthly online budget.

Monthly Budget Reviews and Adjustments

Compare what you planned versus what you spent. Look at each category separately.

Which categories went over budget? Food delivery and impulse purchases are common culprits.

Don’t ignore under-budget categories. If you budgeted $100 for household items but only spent $60 for three months, adjust downward.

Move that extra money to categories that consistently go over. Your budget should match real life, not ideal life.

Track “cost per use” for expensive purchases. That $200 jacket worn twice cost $100 per wear.

Tip: Track your “cost per use” for major online purchases to evaluate spending quality.

Recovering from Budget Overruns

Everyone goes over budget sometimes. The key is how you respond.

Immediate Response to Overspending

Stop all non-essential online purchases immediately. No clothes, gadgets, or entertainment this month.

Figure out what went wrong. One big expense? Multiple impulse buys? Forgotten subscription?

Create a “spending pause.” Close shopping tabs. Remove temptation.

Tip: Create a “spending pause” ritual – close all shopping browser tabs and uninstall shopping apps temporarily.

Getting Back on Budget Track

Reduce next month’s budget in the overspent category. Went $50 over on clothing? Cut clothing by $50 next month.

Look for offline cuts. Pack lunch. Skip coffee shops.

Write down what triggered the overspending. Stress? Boredom? Social media ads?

Don’t beat yourself up. Learn and move forward.

Tip: Write down the lesson learned from each budget overage to build better spending awareness.

Conclusion

Managing your online budget doesn’t have to be complicated. You’ve learned the four key steps: assess current spending, set realistic limits, implement controls, and monitor consistently.

Most people see improvements within 60-90 days. Your online spending deserves the same attention as rent or groceries. When you control digital purchases, you free up money for things that truly matter.

The long-term benefits go beyond saving money. You’ll feel more confident and less stressed about finances. You’re building habits that will serve you for years.

Start with one step this week. Track your spending or set up that dedicated account. Small actions lead to big changes.

What’s your biggest online spending challenge? Share in the comments below.